The development of a clean fuel standard across Canada took a major step forward on December 19, 2020, with the publication by the federal government of the draft Clean Fuel Regulation which, once finalized, will take effect in December 2022.

The Clean Fuel Regulation will apply to producers or importers of gasoline, diesel, kerosene, and light and heavy fuel oil (referred to as “primary suppliers”). Each type of fuel is assigned a carbon intensity value during the life cycle, expressed in grams of carbon dioxide equivalent per Megajoule of energy (gCO2e / MJ), which is intended to represent the emission intensity of said fuel throughout its life cycle. The carbon intensity values serve as a baseline, against which primary suppliers must make annual reductions.

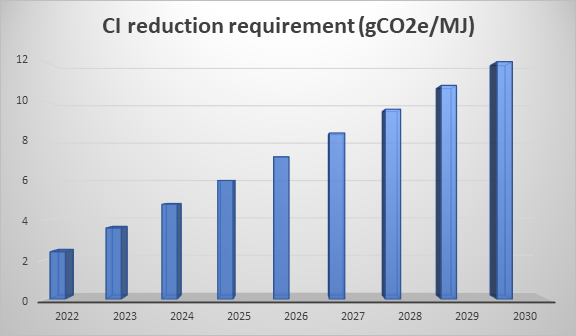

Starting in 2022, each major supplier must reduce the carbon intensity of the fuels it produces or imports by a minimal amount that increases each year, starting with 2.4 gCO2e / MJ in 2022 and culminating with a reduction requirement of 12 gCO2e / MJ in 2030.

These abatement requirements apply to each major supplier throughout the company and will be expressed as an aggregate amount of tons of CO2e for the aggregate of all types of fuel produced or imported by a primary supplier. However, there are several exemptions. For example, abatement requirements will not apply to aviation fuel, fuels exported from Canada, fuels sold or delivered for a use other than combustion (i.e. solvents), fuels produced and used in the same facility. , fuels sold or delivered for use in a marine vessel with international destination, or fuels sold or delivered for non-industrial use in remote communities.

The Clean Fuel Regulations will also maintain the volumetric requirements under the existing Renewable Fuel Regulations (RFR) (2% low carbon fuel content in diesel / fuel oil, 5% low carbon fuel content in gasoline). Prior to the repeal of the RFR in 2024, companies will have the right to transfer any existing compliance units and convert those units into recognized credits under the Clean Fuel Regulations.

Compliance options for Primary Suppliers

Primary suppliers must meet their emission reduction requirements by creating or purchasing compliance credits (each represents a life cycle emission reduction of one ton CO2e). Primary providers can earn compliance credits by:

- carrying out activities that generate credits on their own;

- acquire credits from third parties; or

- pay to a compliance fund to purchase credits at a price of $ 350 / ton (conceptually similar to “technology fund credits” under Alberta’s TIER system).

In particular, credits acquired from the fulfillment fund option can be used to satisfy a maximum of 10% of the annual reduction obligation of a major supplier. In circumstances where primary providers cannot purchase enough fulfillment units through the credit clearing mechanism (see below), they can carry over up to 10% of their fulfillment obligation to subsequent fulfillment periods of up to two years. However, an annual interest rate of 20% is applied to the amounts carried forward.

Credit generation and credit market

While primary suppliers are the only entities required to reduce the life cycle emissions of their fuels, the Clean Fuel Regulations create three distinct categories of compliance actions that allow primary suppliers as well as “creditors volunteers “, create credits that will eventually be sold to primary providers. to meet your emission reduction requirements:

Compliance Category 1: Actions taken to reduce the carbon emissions of a fuel throughout its life cycle (eg carbon capture and storage);

Compliance Category 2: Supply of low-carbon fuels (eg, ethanol, biodiesel, including fuels used to meet existing federal and provincial renewable fuel requirements); and

Compliance Category 3: Fuel switching for transportation, through end users changing or adapting combustion devices to work with alternative energy sources, such as electric vehicles, natural gas vehicles and hydrogen fuel cell vehicles .

When it comes to credit generation, the Clean Fuel Regulations rely heavily on the offset generation methodology used in Alberta’s TIER system, with credit generation conditional on compliance with government-approved quantification methods. , subject to third party verification. Four initial quantification methodologies have been identified for development with respect to Compliance Category 1, including: (i) carbon capture and storage; (ii) low-carbon electricity generation; (iii) enhanced oil recovery; and (iv) co-processing of biocrudes in refineries and upgraders.

In addition, a generic quantification methodology will be developed that can be used for activities that do not have their own customized quantification methodology, which will be applied to projects such as energy efficiency, cogeneration, electrification and methane reductions.

Like credits purchased through contribution to a compliance fund, the Clean Fuel Regulations also establish certain limits on the use of credits generated through compliance categories. A primary supplier can meet only 10% of its reduction requirement through emission reduction projects that are based on the generic quantification methodology. Similarly, while the Clean Fuel Regulations allow primary suppliers to create credits in relation to solid and gaseous fossil fuels and use those credits to offset liquid fuel reduction requirements, such cross-class credits can only be used to satisfy an additional 10% of primary fuels. supplier reduction requirement.

The negotiation of credits created in accordance with the Clean Fuel Regulations can be done through bilateral negotiations between buyers and sellers in a manner similar to how Alberta’s emissions offset and emissions performance credit market operates under TIER. All credit transfers must be registered with the Minister of the Environment and Climate Change. Additionally, both primary providers and voluntary creditors will be subject to third-party verification, record-keeping, and compliance reporting requirements similar to those of Alberta’s TIER system and the federal production-based pricing system for large emitters in accordance with greenhouse gas pollution prices. Act.

The Clean Fuel Regulation also contemplates a credit compensation mechanism (CCM) to facilitate the exchange of credits. A credit seller can promise to sell your credits in accordance with the MCP. Once the credits have been committed to the CCM, the credit seller is obliged to sell those credits at the CCM price (currently set at $ 300 / ton) and has no right to accept an offer to buy the credits at a price higher. When a primary vendor has not met its reduction requirements by June 30 of a given calendar year, the primary vendor can purchase credits through the CCM. If there are not enough credits in the CCM to satisfy the requests of all primary providers, each primary provider will be entitled to purchase a prorated portion of the available credits.

Key takeaways

The Clean Fuel Regulations, once implemented, will present compliance challenges for primary providers, as well as credit generation opportunities for both primary providers and voluntary credit originators. Bennett Jones has extensive experience advising entities on compliance strategies, as well as in the development of GHG credit projects and the commercialization of GHG credits in both the compliance and voluntary markets.